ABOUT

INITIAL PUBLIC OFFERING - IPO OF COMPANIES

Introduction

An IPO is short for an initial public offering. It is when a company

initially offers shares of stocks to the public. It's also called "going

public." An IPO is the first time the owners of the company give up part

of their ownership to stockholders. Before that, the company is privately-owned.

What IPOs Mean to the Economy

The number of IPOs being issued is usually a sign of

the stock market's and economy's health. During a recession,

IPOs drop because they aren't worth the hassle when share prices are

depressed. When the number of IPOs increase, it can mean the economy is getting

back on its feet again.

Why does a company offer an IPO?

- Offering an IPO is a

money-making exercise. Every company needs money, it may be to expand, to

improve their business, to better the infrastructure, to repay loans, etc

- Trading stocks in the open

market mean increased liquidity. It opens door to employee stock ownership

plans like stock options and other compensation plans, which attracts the

talents in the cream layer

- A company going public means

that the brand has gained enough success to get its name flashed in the

stock exchanges. It is a matter of credibility and pride to any company

- In a demanding market, a

public company can always issue more stocks. This will pave the way to

acquisitions and mergers as the stocks can be issued as a part of the deal

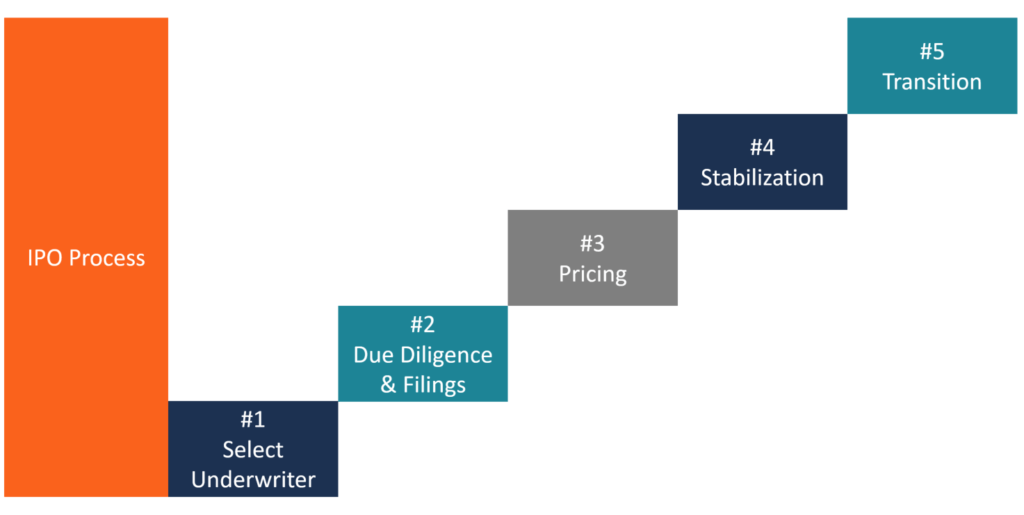

The IPO Process

According to the Corporate Finance Institute. there

are five steps in the IPO process. First, the owners must select a

lead investment bank. This beauty contest occurs six months before the IPO,

according to CNBC. Applicant banks submit bids that detail how much the IPO will raise and

the bank's fees. The company selects the bank based on its reputation, the

quality of its research, and its expertise in the company's industry.

The company wants a bank that will sell the shares to as many banks,

institutional investors, or individuals as possible. It's the bank's

responsibility to put together the buyers. It selects a group of banks and

investors to spread around the IPO's funding. The group also diversifies the

risk.

Banks charge a fee between 3% to 7% of the IPO's total sales price.

The process of an investment bank handling an IPO is called

underwriting. Once selected, the company and its investment bank write the

underwriting agreement. It details the amount of money to be raised, the type

of securities to be issued, and all fees. Underwriters ensure that the

company successfully issues the IPO and that the shares get sold at a certain

price.

The second step is the due diligence and regulatory filings.

It occurs three months before the IPO. This is prepared by the IPO team. It

consists of the lead investment banker, lawyers, accountants, investor

relations specialists, public relations professionals, and SEC experts.

The team assembles the financial information required. That includes

identifying, then selling or writing off, unprofitable assets. The team must

find areas where the company can improve cash flow. Some companies also look for new management and a

new board of directors to run the newly public company.

The investment bank files the S-1 registration statement with the SEC.

This statement has detailed information about the offering and company info.

According to CNBC,4 the

statement includes financial statements, management background, and any legal

problems. It also specifies where the money is to be used, and who owns any

stock before the company goes public. It discusses the firm's business model,

its competition, and its risks. It also describes how the company is governed

and executive compensation.

The SEC will investigate the company. It makes sure all the information

submitted is correct and that all relevant financial data has been disclosed.

The third step is pricing. It depends on the value of the

company. It also is affected by the success of the road shows and the condition

of the market and economy.

After the SEC approves the offering, it will work with the company to

set a date for the IPO. The underwriter must put together a prospectus that

includes all financial information on the company. It circulates it to

prospective buyers during the roadshow. The prospectus includes a three-year

history of financial statements. Investors submit bids indicating how many

shares they would like to buy.

After that, the company writes transition contracts for vendors. It must

also complete financial statements for submission to auditors.

Three months before the IPO, the board meets and reviews the audit. The

company joins the stock

exchange that lists its IPO.

In the final month, the company files its prospectus with the SEC. It

also issues a press release announcing the availability of shares to

the public.

The day before the IPO, bidding investors find out how many shares they

were able to buy.

On the day of the IPO, the CEO and senior managers assemble at either

the New York Stock Exchange or NASDAQ for the first day of trading. They often

ring the bell to open the exchange.

The fourth step is stabilization. It occurs immediately after

the IPO. The underwriter creates a market for the stock after it's issued. It

makes sure there are enough buyers to keep the stock price at a reasonable

level. It only lasts for 25 days during the "quiet period."

The fifth step is the transition to market competition. It

starts 25 days after the IPO, once the quiet period ends. The underwriters

provide estimates about the company's earnings. That assists investors as they

transition to relying on public information about the company.

Six months after the IPO, inside investors are free to sell their

shares.

Metrics for judging a

successful IPO process

The following metrics are used for

judging the performance of an IPO:

Market Capitalization: The IPO is considered to be successful if the

company’s market capitalization is equal to or greater than the market

capitalization of industry competitors within 30 days of the initial public

offering. Otherwise, the performance of the IPO is in question.

Market Capitalization = Stock Price x

Total Number of Company’s Outstanding Shares

Market Pricing: The IPO is considered to be successful if the

difference between the offering price and the market capitalization of the

issuing company 30 days after the IPO is less than 20%. Otherwise, the

performance of the IPO is in question.

Advantages

The IPO is an exciting time for a company. It means it has become

successful enough to require a lot more capital to

continue to grow. It's often the only way for the company to get enough cash to

fund a massive expansion. The funds allow the company to invest in new capital

equipment and infrastructure. It may also pay off debt.

Stock shares are useful for mergers and acquisitions. If the company

wants to acquire another business, it can offer shares as a form of payment.

The IPO also allows the company to attract top talent because it can

offer stock options. They will enable the company to pay its

executives fairly low wages up front. In return, they have the promise that

they can cash out later with the IPO.

For the owners, it's finally time to cash in on all their hard work.

These are either private equity investors or senior management. They usually

award themselves a significant percentage of the initial shares of stock.

They stand to make millions the day the company goes public. Many also enjoy

the prestige of being listed on the New York

Stock Exchange or NASDAQ.

For investors, it's called getting in on "the ground floor."

That's because IPO shares can skyrocket in value when they are first made available

on the stock market.

Disadvantages

The IPO process requires a lot of work. It can distract the company

leaders from their business. That can hurt profits. They also must hire

an investment

bank, such as Goldman Sachs or Morgan

Stanley. These investment firms are tasked with guiding the company

as it goes through the complexities of the IPO process. Not surprisingly, these

firms charge a hefty fee.

Second, the business owners may not be able to take many shares for

themselves. In some cases, the original investors might require them to put all

the money back into the company. Even if they take their shares, they may not

be able to sell them for years. That's because they could hurt

the stock price if

they start selling large blocks and investors would see it as a lack of

confidence in the business.

Third, business owners could lose ownership control of the business

because the Board of Directors has the power to fire them.

Fourth, a public company faces intense scrutiny from regulators

including the Securities

and Exchange Commission. Its managers must also adhere to the Sarbanes-Oxley

Act. A lot of details about the company's business and its owners

become public. That could give valuable information to competitors.

No comments:

Post a Comment